Canal Mail Corp: Your Hub for Daily Insights

Explore the latest news, tips, and trends across various topics.

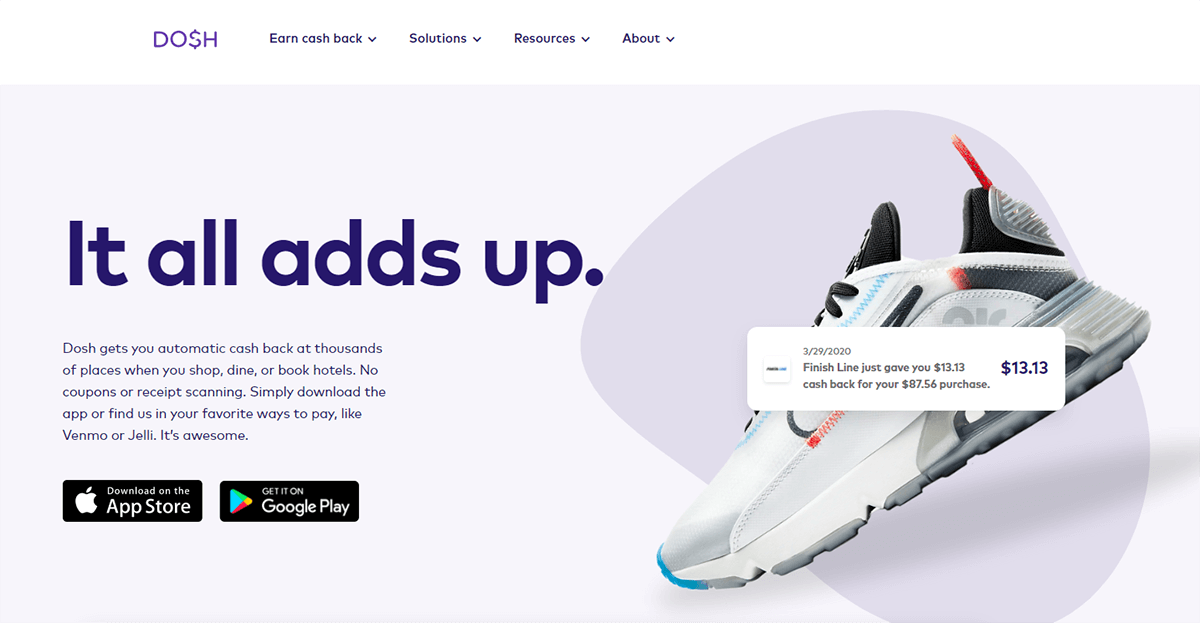

Cashback Loyalty Systems: Turning Your Everyday Spending into Unexpected Adventures

Unlock exciting adventures with cashback loyalty systems! Discover how your everyday spending can lead to unexpected rewards and experiences.

How Cashback Loyalty Systems Work: A Complete Guide

A cashback loyalty system is a popular marketing strategy designed to incentivize customer purchases by offering a percentage of the transaction amount back to the buyer. These systems typically operate through a straightforward process: customers make purchases at participating retailers, and a specified percentage of their total spend is credited back to their account. For example, if a customer spends $100 at a store with a 5% cashback offer, they would receive $5 back. This process not only encourages repeat business but also helps in building brand loyalty as customers begin to see real benefits from their purchases.

The mechanics of cashback loyalty systems can vary between companies, but they often include a few common components. First, customers need to sign up for the program, which may involve creating an online account or downloading a mobile app. Once registered, customers typically track their cashback amounts through their online dashboard. Additionally, some programs may have tiered rewards or promotional periods where customers can earn higher percentages during special campaigns. Overall, understanding how cashback loyalty systems work can empower consumers to maximize their savings and enhance their shopping experience.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists in a strategic battle. Players engage in various game modes that emphasize teamwork and skill. For those looking to enhance their gaming experience, a duelbits promo code can provide exciting bonuses and rewards.

Maximizing Your Earnings: Tips to Leverage Cashback Programs

Cashback programs have become a popular way for consumers to save money while shopping, and leveraging them effectively can significantly boost your earnings. To maximize your cashback benefits, start by researching different programs to find those that offer the highest rewards for your shopping habits. For instance, consider using credit cards that provide up to 5% cashback on certain categories like groceries, gas, or online shopping. Additionally, signing up for cashback websites can help you earn money back on purchases made at your favorite retailers. By combining these strategies, you can dramatically increase your cashback earnings.

Another tip for maximizing your cashback is to stay updated on promotional events and seasonal offers. Many cashback programs offer limited-time bonuses or increased cashback percentages during holidays and special occasions. To ensure you never miss out, subscribe to newsletters or follow your favorite cashback programs on social media. You can also create a budget that incorporates cashback opportunities by aligning your purchases with these promotions. Remember, planning your shopping around the best cashback deals can lead to impressive savings over time.

Are Cashback Loyalty Systems Worth It? Debunking Common Myths

Cashback loyalty systems have gained immense popularity in recent years, but are they truly worth it? Many people perceive these programs as a way to save money effortlessly, yet there are several common myths that can lead to misguided expectations. For instance, some consumers believe that they will receive substantial cashback rewards with every purchase. In reality, most cashback programs require consumers to meet certain conditions, such as spending thresholds or only receiving rewards on select purchases. Understanding these limitations is crucial before diving headfirst into a loyalty program.

Another prevalent myth surrounding cashback loyalty systems is that they always provide better savings compared to traditional discounts or offers. While it's true that cashback rewards can add up over time, consumers often overlook the fact that these programs can sometimes encourage excessive spending. Rather than focusing on necessities, individuals may find themselves purchasing items they don't need just to earn cashback. Therefore, it's essential for consumers to analyze their spending habits and consider whether the potential rewards truly align with their financial goals before committing to a cashback system.